Your help helps us to inform the story

From reproductive rights to local weather change to Huge Tech, The Impartial is on the bottom when the story is growing. Whether or not it is investigating the financials of Elon Musk’s pro-Trump PAC or producing our newest documentary, ‘The A Phrase’, which shines a light-weight on the American ladies combating for reproductive rights, we all know how necessary it’s to parse out the info from the messaging.

At such a vital second in US historical past, we want reporters on the bottom. Your donation permits us to maintain sending journalists to talk to either side of the story.

The Impartial is trusted by Individuals throughout the whole political spectrum. And in contrast to many different high quality information shops, we select to not lock Individuals out of our reporting and evaluation with paywalls. We imagine high quality journalism ought to be out there to everybody, paid for by those that can afford it.

Your help makes all of the distinction.

Adella Bass dropped her in-person school courses as a result of it was simply too arduous to get there from the far South Aspect of Chicago, the place the town’s well-known elevated practice does not run. And it will possibly take her almost two hours to get to the hospital the place she is handled for a coronary heart situation.

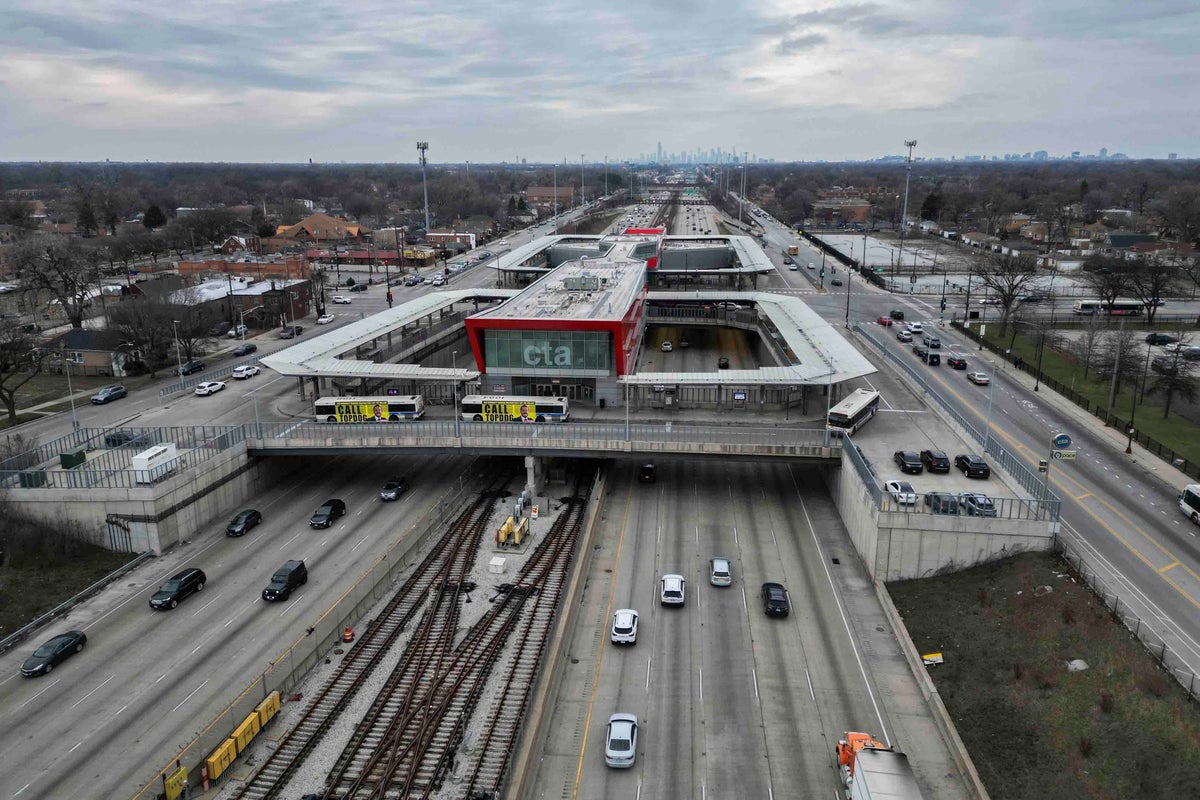

However issues are trying up, with brilliant pink indicators throughout the realm boldly proclaiming, “Prepared, Set, Quickly!” Subsequent 12 months, the town is poised to start out making good on a decades-old promise to attach a few of its most remoted, poor and polluted neighborhoods to the remainder of the town by way of mass transit.

The Biden administration notified Congress final week that it could commit $1.9 billion towards an almost $5.7 billion venture so as to add 4 new L stations on the South Aspect, the Chicago system’s largest growth venture in historical past. The pledge, which the Federal Transit Administration is predicted to formally signal earlier than President Joe Biden leaves workplace in January, primarily locks in present and future funding.

Nonetheless, Bass fears President-elect Donald Trump‘s administration would possibly attempt to scuttle it.

Alerts abound to guarantee residents that the venture is “a go,” stated Bass, who’s elevating three younger kids and works on well being fairness points that have an effect on residents of a large public housing growth close to her South Aspect house. “However you simply by no means know with Trump.”

May Trump slash transit funding?

The $1 trillion infrastructure plan Biden signed into regulation in 2021 centered much more closely on transit than something his predecessor advocated. That’s the reason there was a scramble to finalize some transit grants earlier than Biden’s time period ends, together with commitments final week for speedy transit upgrades in San Antonio and Salt Lake Metropolis.

Yonah Freemark, a researcher on the City Institute, stated Trump unsuccessfully inspired Congress in his first time period to cross budgets eliminating funding for some new transit initiatives that hadn’t secured their grant agreements. Nevertheless it has been virtually extraordinary for administrations to claw again initiatives after they received closing approval.

Steve Davis, who handles transportation technique for Sensible Development America, stated Trump may attempt to redirect future aggressive grants to prioritize freeway development over various transportation strategies comparable to transit. He stated Trump’s Transportation Division may doubtlessly decelerate some allocations from already accepted infrastructure initiatives however would have bother halting them solely.

“If you happen to’re constructing an infinite $2 billion street widening, it is advisable to know you are going to have cash in 12 months 4 or 5 and there is nothing a hostile administration may do to cease it,” Davis stated.

Bringing again jobs by way of entry

One of many communities that will be served by a brand new Chicago L station is Roseland, a once-thriving, predominantly Black enterprise district that has fallen sufferer to the lack of manufacturing and a spike in crime.

Jervon Hicks, who spent a few years out and in of jail on gun prices, turned his life round and ended up turning into a mentor for at-risk youth. The brand new station may assist quicken the identical transition for others, he stated.

“Roseland wants a makeover,” Hicks stated. “We lack a pet retailer. We used to have a theater. Take a few of these deserted buildings and switch them into job alternatives.”

Not like the busy “Magnificent Mile” buying district on Michigan Avenue within the downtown Chicago Loop, the enterprise district on South Michigan Avenue in Roseland has fallen from greater than 90% occupancy many years in the past to round 10% now.

Among the many surviving companies is Edwards Fashions. Proprietor Ledall Edwards hopes transportation will spur extra to return.

“I don’t suppose it’ll get to the extent it was again within the Seventies, however I feel the atmosphere goes to enhance due to the accessibility,” he stated. “You’re going to have the ability to get folks right here on this space a lot sooner.”

Rogers Jones, who for 30 years has run the Youth Peace Middle subsequent to the longer term practice station, stated he cannot anticipate the transformation.

“The group goes to vary,” Jones stated. “It’s going to be a vibrant group, and individuals are excited. I do know I’m excited.”

A 55-year-old promise

Former Chicago Mayor Richard J. Daley instructed residents of Roseland and surrounding areas in 1969 that the L would finally increase there.

Tammy Chase, a spokesperson for the Chicago Transit Authority, stated the price then would have been $114 million in comparison with round $5.7 billion now, a determine that will preserve rising the longer development is delayed.

The company has employed a development agency, opened a Roseland workplace in a former paint retailer and begun boarding up properties that will probably be demolished for the tracks to run by way of. Floor is predicted to be damaged in late 2025, Chase stated.

U.S. Rep. Mike Quigley of Illinois, the highest Democrat on the subcommittee that oversees transportation spending, factors out Chicago’s transit system survived wars and melancholy. It certainly can also stand up to a pandemic and a presidential administration with completely different priorities, he stated.

“The massive infrastructure initiatives stand the take a look at of time,” Quigley stated. “These ups and downs, you must regulate to them, however you acknowledge transit all the time comes again. If transit doesn’t come again, it stymies alternatives going ahead.”

#Remoted #Chicago #communities #safe #cash #coveted #transit #venture #Trump #takes #workplace

The Impartial

#Remoted #Chicago #communities #safe #cash #coveted #transit #venture #Trump #takes #workplace

Jeff McMurray , 2024-12-22 05:08:00