In simply two years, ChatGPT has managed to do one thing no firm has achieved within the final 20 years: current a viable problem to Google.

There’s proof that persons are utilizing it as a substitute of conventional search in an growing variety of instances.

For instance, ChatGPT’s visitors not too long ago surpassed Bing, and its referral visitors has been rising by triple digits.

But, Google’s search volumes and market share look like unaffected. Is it a query of scale, and is ChatGPT’s affect nonetheless too small to register? In that case, maybe not for for much longer

There have been a number of shopper surveys asking about present perceptions of search high quality and others exploring AI adoption. However, there haven’t been any research that appeared carefully into whether or not AI impacts shopper attitudes towards Google and their utilization of Search.

So, we determined to create one to reply a variety of direct questions we have been curious to know the solutions to:

- Is it simpler or tougher to search out what you’re searching for on Google vs. three years in the past?

- What’s your “go-to” AI instrument, and the way usually do you employ it?

- What do you want about AI?

- Are AI functions and engines like google mainly interchangeable or totally different?

- Has utilizing AI modified how a lot you employ Google?

- Does AI or search present a greater expertise (throughout a number of classes)?

- Should you had to decide on just one instrument (Search or AI), what wouldn’t it be?

- Will AI substitute conventional engines like google within the subsequent three years?

My analysis program, Dialog, requested these and quite a few different inquiries to a web-based shopper panel final month. We certified potential respondents utilizing two standards:

- They needed to be no less than weekly search customers.

- They will need to have used no less than one AI utility “ever” (on a listing of 11).

We recruited greater than 2,200 respondents and disqualified over half of them, most actually because they didn’t reply sure to the AI screening query.

In the long run, we had 1,000 U.S. respondents who roughly mirrored U.S. Census knowledge.

Key Survey Findings

Listed below are a few of the survey’s main findings:

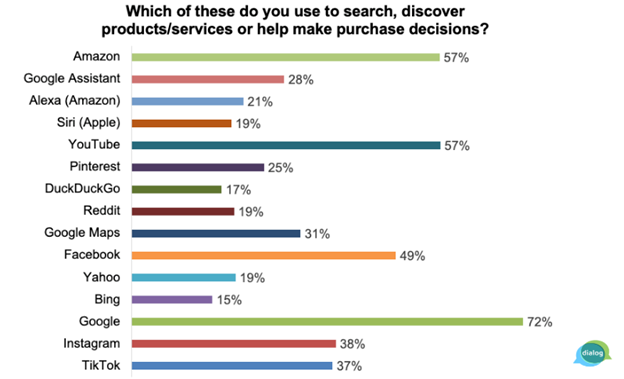

- Whereas Google is dominant, shoppers use a number of websites to make buy choices.

- 44% of U.S. adults have used AI functions no less than as soon as (100% of respondents had).

- 77% of survey respondents stated it had develop into simpler to search out issues on Google.

- 57% use AI each day; roughly half of them use it a number of occasions a day.

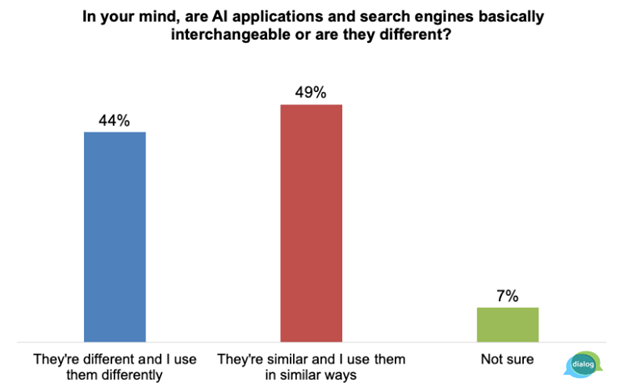

- 49% see AI and search as primarily interchangeable.

- 67% assume AI will doubtless substitute conventional engines like google inside three years.

Search Is Fragmenting

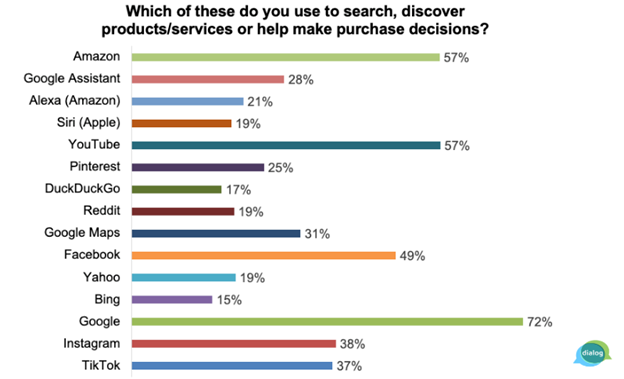

It’s necessary to level out that the usually binary dialogue of Search vs. AI misses the truth that individuals have been utilizing quite a few different websites for search and discovery for a while.

Some individuals may be shocked, for instance, {that a} majority of U.S. adults on TikTok are searching for product evaluations and suggestions.

Dialog’s survey suggests that individuals routinely use a number of websites to conduct pre-purchase analysis, although Google is essentially the most broadly used.

The exact percentages are much less necessary than the truth that so many websites have been named.

Picture from writer, December 2024Search As we speak Is ‘A lot Simpler’

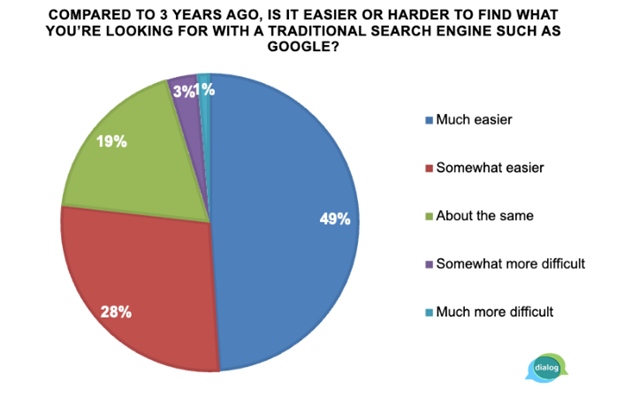

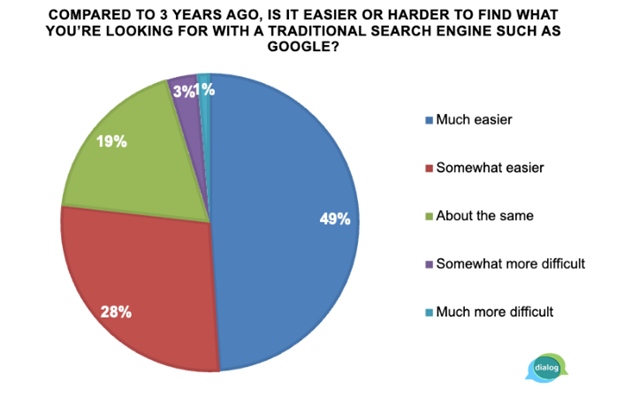

The final consensus within the search engine optimization neighborhood and tech press is that Google’s search high quality has declined for a number of years.

Should you don’t consider this, simply Google “Is Google getting worse?” (There’s an extended debate as to why this may be.)

We totally anticipated shoppers to precise an analogous sentiment. However they didn’t.

In reality, 77% stated that they thought it was simpler or “a lot simpler” to search out what they have been searching for on Google as we speak vs. three years in the past.

Whereas this doesn’t explicitly tackle search high quality, it displays a optimistic person expertise.

Picture from writer, December 2024

Picture from writer, December 2024We didn’t comply with up on this query, so we don’t have a great rationalization for the discovering.

One potential principle is that a lot of search exercise as we speak is brand-related or navigational, which Google does a great job with.

One other principle is that customers have develop into extra succesful searchers. However neither is totally persuasive.

Search And AI Are ‘Interchangeable’

As talked about, we disqualified potential respondents who stated they’d by no means used an AI utility.

Amongst our pattern, nonetheless, there have been only a few rare AI customers; 92% stated they used AI no less than weekly, and 57% have been each day customers, with a considerable minority utilizing it a number of occasions a day.

ChatGPT was the dominant AI instrument, though Gemini was not far behind – and these are common searchers, with 64% utilizing Search/Google a number of occasions a day.

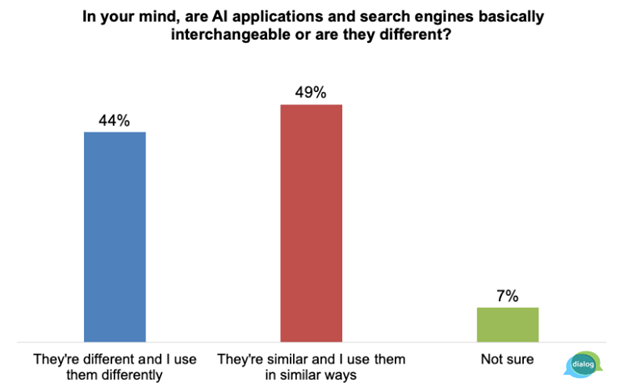

We additionally wished to know whether or not shoppers noticed Search and AI as related instruments or totally different.

Roughly half of our respondents stated that Search and AI have been certainly related and that they used them in related methods. The opposite half stated that they have been totally different or weren’t certain.

Picture from writer, December 2024

Picture from writer, December 2024The broad significance of this discovering is {that a} significant variety of comparatively heavy search customers are probably open to substituting AI (ChatGPT) for Google.

Past this, our respondents stated they preferred many issues about AI/ChatGPT:

- Means to ask follow-up questions – 44%

- Direct solutions vs. web site hyperlinks – 42%

- Total high quality of solutions – 40%

- ‘Conversational’ interplay – 38%

- Extra complete data – 37%

- Lack of adverts – 35%

- Different (please specify) – 1%

Whereas the bulk stated they discovered AI content material reliable, there have been nonetheless considerations about privateness and knowledge accuracy.

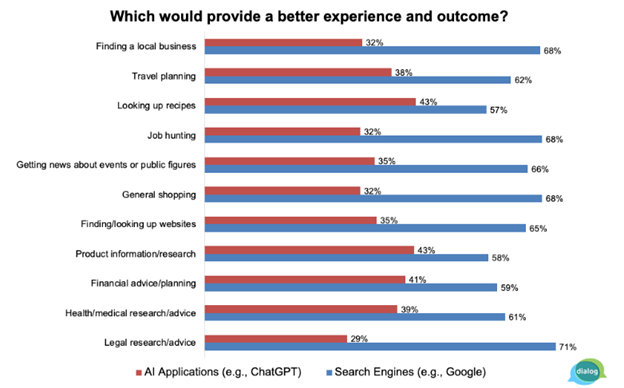

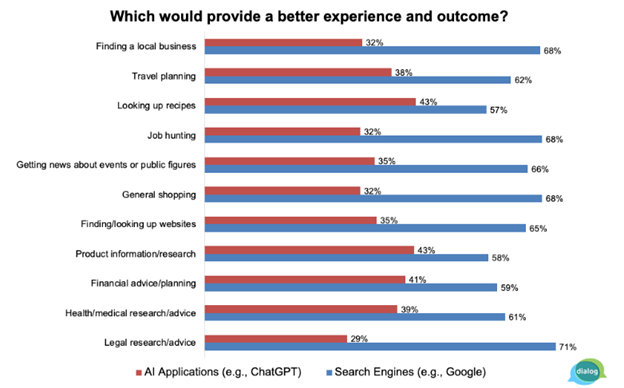

Search Beats ChatGPT – Or Does It?

We requested shoppers to determine whether or not they thought search or AI would offer a greater expertise and final result throughout a variety of content material classes and use instances.

Throughout the board, Google/Search gained. Some classes have been nearer than others (i.e., recipes, product analysis, and monetary planning).

Picture from writer, December 2024

Picture from writer, December 2024This can be a Rorschach-like, “half empty-half full” chart.

Should you’re rooting for Search, you’ll be able to take consolation in Google’s seemingly clear victory. However, the opposite facet of that is {that a} substantial variety of individuals thought AI would do a greater job.

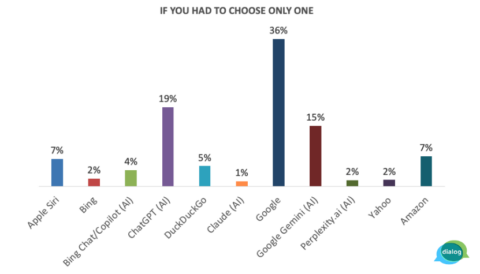

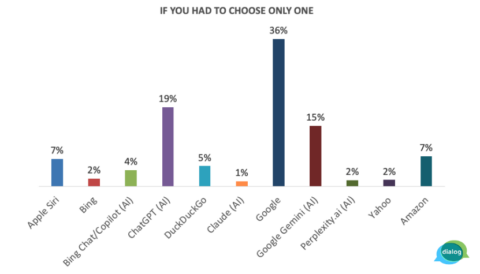

Presenting shoppers with a listing of 11 Search and Search-adjacent instruments, together with Google, Amazon, Yahoo, Perplexity, ChatGPT, and others, we then requested, “Should you had to decide on solely one among these for all of your analysis and buy decision-making wants, which wouldn’t it be?”

Picture from writer, December 2024

Picture from writer, December 2024The most important group of 36% selected Google, as you’ll anticipate. ChatGPT was second, and Gemini got here in third.

While you mix the ChatGPT and Gemini respondents, Google solely prevails by a slim two-point margin.

Conclusion: AI Inevitability?

Greater than two-thirds of those shoppers answered “doubtless” or “very doubtless” to the query, “Will AI substitute search within the subsequent three years?”

Solely 12% stated it was unlikely, and the remainder weren’t certain. Once more, it is a group that likes Google and thinks it delivers a greater expertise than AI normally.

Will Google be displaced in three years? Not an opportunity.

However, the truth that a majority consider it’s attainable might affect their expectations and conduct – it additionally signifies their potential openness to switching. Google has been seen as invulnerable till now.

Feeling aggressive stress, Google is quickly evolving and leaning on AI to beat again the ChatGPT menace.

In doing so, the Google SERP might more and more come to imitate the AI person expertise.

Google CEO Sundar Pichai not too long ago proclaimed that the search expertise would “proceed to vary profoundly in 2025.”

What we all know for certain is that the following part of search will likely be fairly totally different, and that the search panorama might, the truth is, be fragmenting.

Regardless, Google and AI “reply engines” will co-exist, and the shopper journey will undoubtedly develop into much more advanced.

Entrepreneurs will must be versatile and prepared. Enterprise as typical is over.

Extra Sources:

Featured Picture: Pickadook/Shutterstock