Enterprise reporter, PJDM Information

Getty Pictures

Getty PicturesThe UK economic system unexpectedly grew within the closing three months of final yr following a lift to the development and providers sectors.

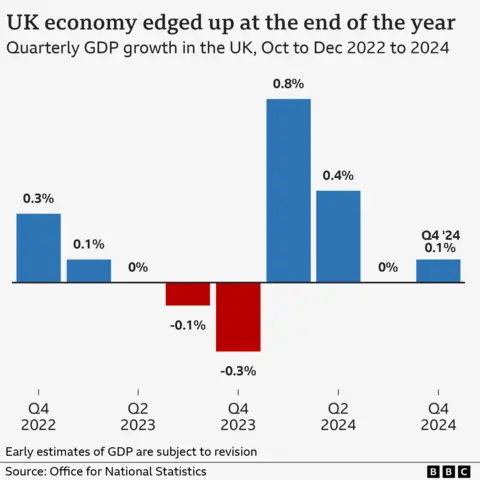

The economic system expanded by 0.1% between October and December, according to official figures, regardless of analysts predicting it could contract.

Development within the quarter was pushed by a variety of industries, from pubs and bars to equipment producers, having a robust December.

Nevertheless, the figures additionally indicated residing requirements final yr had been barely decrease than in 2023 on common.

With tax rises coming into power in April, issues stay that financial development will stay sluggish for someday.

Companies have warned that paying extra in Nationwide Insurance coverage, together with minimal wages rising and enterprise charges aid being diminished, might have an effect on the economic system’s capability to develop, with employers anticipating to have much less money to present pay rises and create new jobs.

The Financial institution of England has additionally halved its development forecast for the UK this yr, amid issues that larger prices for employers might hit hiring, income, funding – and push up costs. Final week, it decided to cut interest rates to 4.5%.

Paul Dales, chief UK economist at Capital Economics, stated the economic system was “all-but stagnating” as companies adjusted for larger prices and “extra uncertainty abroad” – pointing to the introduction of commerce tariffs within the US by President Donald Trump.

He stated it was a transparent that “quite a lot of the weak spot” within the economic system was as a result of rise in taxes on corporations introduced by Chancellor Rachel Reeves in her Price range final yr, with “enterprise sentiment on the ground” and funding and client spending down.

“General, the economic system is unlikely to do greater than transfer sideways over the subsequent six months,” he urged.

However the newest figures exhibiting a return to development on the finish of 2024 might be welcome information for the federal government, which has made rising the economic system its high precedence in its effort to enhance residing requirements.

A separate determine from the Workplace for Nationwide Statistics (ONS) measuring residing requirements fell 0.1% in 2024 in contrast with the yr earlier than. The measure – referred to as actual GDP per head – calculates the amount of products and providers out there to the typical individual within the UK and an individual is deemed higher off the extra they’ve.

When an economic system grows, companies on common have more cash to spend to make use of extra individuals or give pay rises. Corporations making extra income additionally pay extra in tax to the federal government, which might be spent on public providers.

All this collectively, in principle, leaves individuals higher off – nevertheless it takes time for the advantages to be felt, and it doesn’t essentially profit everybody.

In December alone, the economic system was estimated to have grown by 0.4%.

Movie distribution corporations, pubs and bars all had a “sturdy month”, as did industries concerned in equipment manufacturing, based on Liz McKeown, director of financial statistics on the ONS.

Nevertheless, this was offset by weak months in commerce for laptop programming, publishing and automobile gross sales companies.

Within the development sector, the ultimate months of 2024 noticed a rise in new work pushed by new personal housing tasks, however repairs and upkeep work from personal properties fell over the interval, suggesting householders in the reduction of.

‘Folks do not have the cash’

Sushma Solanki, the proprietor of Bolton catering agency Sushma’s Snacks, advised the PJDM the financial state of affairs was “very worrying” as she discovered buying and selling on the finish of final yr very powerful.

“I usually do about 20 to 30 Christmas workplace occasions,” she stated. “As an alternative, I did two, which was very exhausting. Folks do not have the cash.”

She stated she needed to let go an worker partly due to the upcoming rise in Nationwide Insurance coverage.

“It isn’t simply the insurance policies, it is all the pieces. Peppers for my hen dish began off at 79p, they’re £1.85,” she added.

Chris Taylor, the proprietor of espresso store Gran T’s in Manchester, stated he was “shocked” that there had been any development within the economic system.

“Going into final winter was one of many greatest struggles. I feel lots of people had been naturally clinging onto their purse strings. Commerce was not there,” he stated.

“This authorities’s motion plan, with out hitting individuals instantly with larger taxes, is hitting the extent above and that successfully goes to hit individuals a method or one other. It’s actually an oblique punch to the entire economic system.”

Following the discharge of the brand new figures, the chancellor stated she was nonetheless not glad with the efficiency of the economic system.

“It isn’t potential to show round greater than a decade of poor financial efficiency in just some months, however we’re doing what is critical to carry stability to the economic system,” she stated.

Reeves additionally stated the federal government was going “additional and sooner” to “put more cash in individuals’s pockets”.

She additionally reiterated her self-imposed guidelines on borrowing and debt had been “non-negotiable” after stories this week urged the federal government’s official forecaster, the Workplace for Price range Accountability, had downgraded development forecasts.

Shadow chancellor Mel Stride stated Reeves’s Price range was “killing development” within the UK.

“Working individuals and companies are already paying for her selections with ever rocketing taxes, tons of of 1000’s of job cuts and enterprise confidence plummeting,” he added.

Liberal Democrat Treasury spokesperson Daisy Cooper stated the chancellor’s Price range was accountable for “pitiful financial development”.

“Her full pig’s ear of a jobs tax will hammer small companies, the spine of our economic system.”

Further reporting by Peter Ruddick

#economic system #unexpectedly #grew #closing #months

, 2025-02-13 10:35:00