Enterprise reporters

PJDM

PJDMThe Financial institution of England minimize rates of interest on Thursday from 4.75% to 4.5%, the bottom degree for greater than 18 months.

Decrease charges can scale back the price of borrowing, however might additionally imply decrease returns on financial savings.

The PJDM spoke to debtors and savers about how the speed minimize will have an effect on them.

‘We hope to leap on to a greater price’

Becky and Jon Ball, each 40, dwell in Selby, North Yorkshire with their daughters, 12-year-old Sophie and nine-year-old Emily, and their canine Bertie.

Becky works in finance and Jon is a truck driver.

They’ve lived of their home for 11 years, and their five-year mounted time period mortgage ends in April.

They presently face paying an additional £125 per thirty days, with the fee going up from £460 to £585.

Becky hopes the speed minimize means “our price that we have secured on the minute would go down in order that we will soar on to a greater price earlier than April”.

“We have already had discussions about what to chop again on to verify we will meet the additional value.”

However Jon says the drop in rates of interest can even hit their financial savings. “It is swings and roundabouts, you win with one, you lose with one other. It is a actually tough time for everyone.”

‘I am making £40 much less on my financial savings’

Craig Mountaine in Yorkshire has round £35,000 in financial savings in each financial savings accounts and premium bonds.

He says when charges had been at their current peak of 5.25% he was incomes 4.75% on his financial savings, so round £180 a month.

He’s now incomes 4%, which he expects to drop to three.75% as soon as the most recent minimize is factored in, equating to round £140 a month.

“I am in all probability taking a look at dropping £40 a month from the height [to today],” he says.

“As a semi-retired 55-year-old that further earnings from financial savings curiosity allowed me and my spouse to dwell somewhat than merely surviving.”

‘My mortgage might go up by £1,000 – we want extra price cuts’

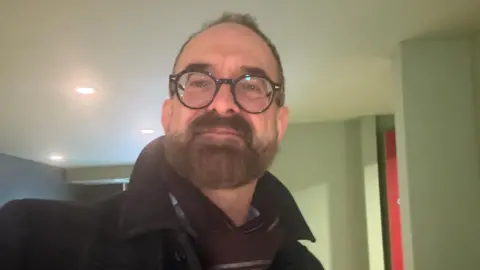

Gino Rocco

Gino RoccoGino Rocco, 59, and his accomplice Robert have a five-year mounted price mortgage that’s coming to an finish in August.

They presently pay simply over £2,000 a month on their newbuild flat in London Bridge. That would go up by £1,000 relying on the deal they handle to land.

He welcomes the minimize in rates of interest, and hopes they proceed downwards in time for when his mortgage is up for renewal.

However he is aware of they are going to nonetheless face a big improve.

“We should make adjustments. I am conscious that for others it will be a lot worse,” says Gino, who works as an in-house solicitor.

He provides that his service cost, heating and water payments have additionally gone up.

“It was snug however with every little thing else going up, it is nearly reasonably priced now.

“It’s not simply individuals on low incomes who’re struggling.”

‘The rate of interest on my bank card is 23% – a 0.25% minimize shouldn’t be sufficient’

Subbu

SubbuSubbu, 48, lives in Dorset along with his spouse and kids.

When the rate of interest on his mortgage went up from 2.1% to five%, his month-to-month repayments elevated by £1,000.

His present mortgage is up for renewal in 2028, so he’s now utilizing a bank card to pay for the elevated prices. The rate of interest on his bank card is 23%.

1 / 4 share level minimize in charges shouldn’t be useful sufficient, he says.

“It is actually powerful in the mean time, I discover that any extra money goes on our fundamental residing wants and we actually haven’t got a lot leftover on the finish of the month.”

Subbu is chatting with a dealer to launch some fairness from the home to repay his bank card. That may imply larger repayments on the mortgage, however he feels that this could possibly be a greater resolution as it’s paid off over an extended time frame in comparison with a bank card.

“It has been very nerve-racking, I do not understand how others handle. I hope that by the point we remortgage once more, charges are so much decrease.”

#Curiosity #price #minimize #Affect #credit score #playing cards #financial savings #mortgages

, 2025-02-07 11:18:00